HELOC in Canada: How much can I borrow?

A home equity line of credit (HELOC) is a line of credit that allows you to borrow from the equity in your home. Home equity is the difference between the value of your home and the unpaid balance of any current mortgage you may have. Your home equity increases with time as you pay your mortgage down and may also increase when your property value appreciates.

Let’s take a simple example to help explain home equity. Say you have a home that is valued at $600,000. You have a mortgage on your home and you still owe $200,000. For now, let’s assume that you only have a primary mortgage and no HELOC (more on that later, including HELOC interest rates in Canada). In this example, your home equity would be $400,000 ($600,000 – $200,000).

The maximum amount that someone can qualify for with a HELOC is determined by a calculation called “loan to value” or LTV. LTV is calculated by the amount of the loan – which could be in the form of a primary mortgage or a HELOC – divided by the value of the home. For a HELOC, the maximum LTV is 65%. But an important additional factor is that your primary mortgage plus a HELOC cannot equal more than 80% LTV. Confused yet? Let’s look at a similar example to help better illustrate what this all means.

Just like the example above, you have a home that is valued at $600,000. You also have a primary mortgage of $200,000. Now remember, the maximum LTV on your home is $600,000 X 80% = $480,000. You have a primary mortgage of $200,000, so the maximum HELOC amount is $280,000 ($480,000 – $200,000).

But wait! There’s one more step. The maximum amount of a HELOC is 65% LTV. So, let’s check to see if the maximum HELOC is greater than 65% LTV: $280,000 divided by $600,000 = approximately 47%. In this case, you would qualify for a maximum of $280,000.

What are HELOCs used for?

Now that you know how much money you could potentially get with a HELOC, there are a couple of other important considerations before you decide whether a HELOC is right for you. The first is home equity line of credit rates in Canada, which we will address in detail below. The second consideration include the ways a HELOC mortgage can be used. Essentially, you need to ask yourself: what would I pay for if I tapped into my home equity?

Here are some of the most common uses of a HELOC:

Home improvement: Have you always wanted a new kitchen? How about an updated bathroom? A HELOC may be a way to get those projects done. Just remember though, that HELOC interest rates, since they are tied to prime, will increase in a rising rate environment. In addition, you will have to make regular interest payments, and will eventually have to pay back the principal.

Debt consolidation: Because a HELOC is secured to your home, HELOC interest rates in Canada tend to be lower than other forms of debt. This includes credit cards, personal (unsecured) lines of credit, and auto loans. Although the home equity loan line of credit interest rate in Canada may be lower, it does come with an increased risk compared to an unsecured loan. This is because a lender can call the loan if you fail to make payments, which means you could lose your home.

Financial gifts: If you have grandchildren or perhaps children that still have student loans, a HELOC may be a good option to help with a down payment or to pay back student loans.

Home equity line of credit interest rates in Canada

HELOC interest rates in Canada are only available in variable terms. This means that HELOC interest rates will not be fixed over any duration of the loan and will instead move every time the prime rate changes. Typically, the major banks in Canada will change their prime rate when the Bank of Canada changes its prime rate. As soon as the HELOC interest rate changes, your minimum payments will also change as a result. This can cause uncertainty and anxiety amongst borrowers.

Let’s look at some examples of HELOC rates:

How do you pay interest on a HELOC?

HELOC interest payment works much like a credit card which allows you to borrow against your spending limit. With a HELOC mortgage, you can borrow against your eligibility limit as often as you need to, and you have the flexibility to repay and repeat your borrowing. The interest payment on HELOC falls under two phases:

Draw Period: While this period varies, the typical range is between 3 and 10 years. During this time, you can borrow from your approved credit limit by check, bank transfer or a linked credit card, and make interest-only monthly payments, with principal repayment being optional (depending on the terms of your loan). Note: Some lenders may charge a fee if you repay the loan early.

Repayment Period: Once the draw period ends, your loan converts to a repayment schedule, and your monthly payments start including both interest and principal. During this period, you can no longer borrow against your approved credit limit, until you have fully repaid the interest, as well as principal on the withdrawn HELOC mortgage amount.

Some lenders may offer an indefinite term HELOC, which does not have any distinct draw and repayment periods. Typically, you can make interest-only payments, or also repay the principal amount, without any prepayment penalties.

Impact of HELOC rule changes on the interest rates

Around 2019, several Canadian lenders adopted a new rule that requires applicants to prove that they can afford to make the monthly HELOC payment based on the limit of the HELOC, instead of the actual borrowed amount. Essentially, the rule acts as though the borrower is maxing out the HELOC. This has already made it tougher for those seeking a HELOC to finance a second home. More recently, tighter regulations on all types of mortgages, including HELOCs, have made it even harder for many Canadians to borrow against their home equity. New HELOC rules state that the mortgage applicant should be able to repay the HELOC within 25 years. To qualify under this rule, banks use their posted 5-year rate, which is usually significantly higher than the typical HELOC interest rates. Moreover, the applicant has to prove affordability on the HELOC credit limit, and not on the amount actually used. Additionally, the lenders also have to factor in the debt-service ratio. For this purpose, they look at credit card limits, and the applicants’ abilities to manage other debts. With Bank of Canada’s interest rates expected to rise in the coming months, HELOC interest rates in Canada are set to increase as well. Due to its variable interest rate only nature, HELOC may become more and more unaffordable despite being a relatively low cost borrowing option (as compared to credit cards or unsecured debt).

DOWNLOAD OUR FREE RESOURCE

What suits your needs? Reverse mortgage or HELOC

HELOCs vs. reverse mortgages in Canada

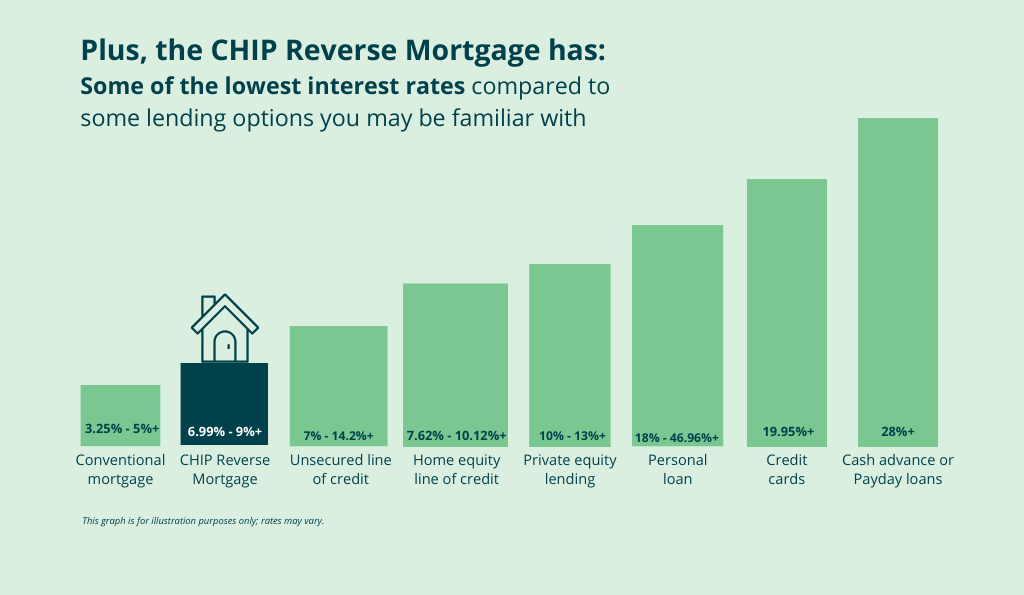

While the interest rates associated with a reverse mortgage are typically higher than a conventional mortgage or home equity line of credit (HELOC), there are 3 key benefits the CHIP Reverse Mortgage® has that the other two can’t provide.

For one, there are no regular mortgage payments required (which is the primary reason why reverse mortgage rates are higher than HELOC mortgage rates). Second, a reverse mortgage allows you to stay in your home as long as you want and lastly, you will never owe more than your home is worth (provided you have met your mortgage obligations, including paying property taxes and home insurance). As an added bonus, the qualification process can be a lot easier for a reverse mortgage than a HELOC. Credit scores and verified income are not nearly as important in qualifying for a reverse mortgage as they are for HELOCs.

Before deciding which option is right for you, it is important to look at all of the advantages and disadvantages. The CHIP Reverse Mortgage allows you to cash in up to 55% of your home’s value without having to make any monthly mortgage payments. You get to stay in the home you love while having the money (and the freedom) to finance your longer, more fulfilling retirement.

To find out how much tax-free cash you could qualify for, call us at 1-866-522-2447 or get your free reverse mortgage estimate now.